Forex trading, also known as foreign exchange trading, refers to the act of buying and selling currencies in the foreign exchange market with the goal of making a profit. It is one of the most actively traded markets in the world, with a daily trading volume exceeding $6 trillion. Forex trading involves a unique set of strategies and market dynamics that traders must understand to navigate this complex field successfully. For those seeking to engage in forex trading, choosing the forex trading definition Best Platforms for Trading is crucial.

What is Forex Trading?

Forex trading is the global marketplace for exchanging national currencies against one another. It operates 24 hours a day, five days a week, making it the most accessible financial market for individuals, corporations, and institutional traders. The main purpose of forex trading is to facilitate international trade and investment by allowing currency conversion. Traders in this market speculate on price fluctuations to earn profits.

The Forex Market Structure

The forex market is decentralized and operates over-the-counter (OTC), meaning that trades are conducted electronically via a network of banks, brokers, and other financial institutions. The main players in this market include:

- Central Banks: They manage national currency and economic policy, influencing currency value through interest rate changes and other measures.

- Commercial Banks: Major banks conduct large amounts of forex transactions for clients and for proprietary trading.

- Corporations: Businesses trade in forex to hedge against exchange rate fluctuations when conducting international trade.

- Retail Traders: Individual traders engage in forex trading, often using online platforms provided by brokers.

How Forex Trading Works

Forex trading involves trading currency pairs, which represent the exchange rate between two currencies. Each pair consists of a base currency (the first currency) and a quote currency (the second currency). For example, in the EUR/USD pair, the euro is the base currency, and the US dollar is the quote currency. Traders speculate on whether the value of the base currency will rise or fall against the quote currency.

When a trader believes that the euro will rise against the dollar, they may buy the EUR/USD pair. Conversely, if they think the euro will decline, they may sell the pair. The goal is to buy low and sell high, capitalizing on price movements.

Key Concepts in Forex Trading

To effectively engage in forex trading, traders must understand several fundamental concepts:

1. Pips and Spreads

A pip is the smallest price movement in forex trading, typically representing the fourth decimal point (0.0001) of a currency pair. The spread is the difference between the buying (ask) and selling (bid) prices. Knowing these concepts is essential for assessing transaction costs and potential profit margins.

2. Leverage

Leverage allows traders to control larger positions with a smaller amount of capital. For instance, a leverage ratio of 100:1 enables a trader to control $100,000 with only $1,000. While leverage can amplify profits, it can also magnify losses, making risk management crucial.

3. Margin

Margin refers to the amount of money a trader must deposit to open and maintain a leveraged position. Understanding margin requirements helps traders manage their risk and ensure they have sufficient capital to cover potential losses.

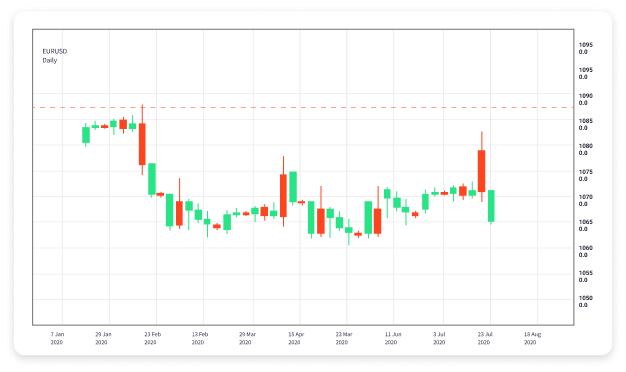

4. Technical and Fundamental Analysis

Traders use technical analysis to study price charts and identify patterns, trends, and market signals. Fundamental analysis, on the other hand, involves evaluating economic indicators, news, and geopolitical events that can influence currency values. A combination of both analyses provides a comprehensive view of market conditions.

Developing a Forex Trading Strategy

Creating a successful forex trading strategy requires a combination of research, analysis, and risk management. Here are some steps to consider:

- Define Your Objectives: Establish clear trading goals, such as profit targets, risk tolerance, and timeframes.

- Choose a Trading Style: Select a trading style that suits your personality and schedule, such as day trading, swing trading, or position trading.

- Analyze the Market: Use technical and fundamental analysis to identify potential trading opportunities and market trends.

- Implement Risk Management: Set stop-loss orders to limit potential losses and ensure that you never risk more than a predetermined percentage of your trading capital.

- Review and Adjust: Continuously monitor your trading performance and adjust your strategy based on market conditions and personal experiences.

The Role of Forex Brokers

Forex brokers act as intermediaries between retail traders and the interbank forex market. They provide trading platforms, access to market information, and execute trades on behalf of clients. When choosing a broker, it’s essential to consider factors such as regulation, trading fees, customer support, and the range of available currency pairs.

Common Mistakes in Forex Trading

Despite the potential for profit, many traders make common mistakes that hinder their success:

- Lack of a Trading Plan: Entering trades without a well-defined strategy can lead to impulsive decisions and losses.

- Overleveraging: Using too much leverage increases risk and can result in significant losses.

- Emotional Trading: Letting emotions drive trading decisions often leads to poor outcomes.

- Neglecting Risk Management: Failing to implement risk management techniques can expose traders to excessive losses.

Conclusion

Forex trading offers significant opportunities for profit in the global financial market, but it also comes with inherent risks. Understanding the definition of forex trading, the market structure, key concepts, and strategies is crucial for success. By developing a solid trading plan, implementing risk management techniques, and continually educating oneself, traders can increase their chances of success in this dynamic market.